Missouri Landowner Secures $1MM Adjustable-Rate Loan to Boost Operational Liquidity

Learn how a returning borrower refinanced equipment debt and improved liquidity with a $1MM 5-year ARM loan.

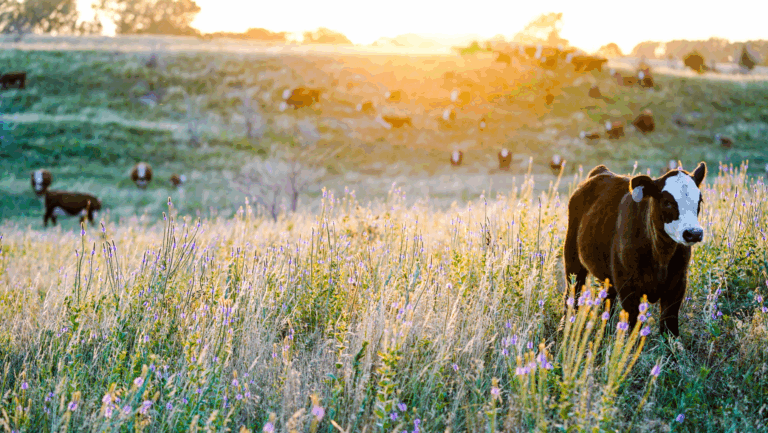

Farmers often rely on the land they own to support and expand their operations. Whether it’s growing crops or raising cattle, land serves as a critical asset that can be leveraged to secure necessary capital for an operation. But to leverage your land effectively, it is essential to work with a lender who understands both the financial and ag markets to curate the best farmland loan for you.

The Challenge

A long-time landowner in Missouri who owned more than 900 acres of cropland and cattle ranch was looking to boost his operating capital to manage higher input costs. Having been a loyal AgAmerica client since 2020, he came to us to assess the financial health of his operation and explore his options.

The Solution

AgAmerica reviewed his balance sheet and realized a strategic refinance of farm equipment debt could inject some additional liquidity into the operation. We proposed a 30-year loan with a short-term adjustable-rate mortgage (ARM) loan so he could secure the most competitive rate in the current rate environment, while also giving him the flexibility to lock in an even lower rate in a few years should rates drop. The result was a $1MM 30-year term loan with a 5-year ARM, structured to refinance the equipment debt and provide the liquidity needed to support his long-term financial success.