Alabama Cattle Rancher Overcomes High Rate with $970K Refinance

Farm loan interest rates reached a 20-year high in 2023.

To combat inflation, the Federal Reserve adopted an aggressive rate hike schedule that resulted in the federal fund rate rising to 5.5 percent in July of 2023, the highest seen in 22 years.

Because agriculture loans tend to have a higher rate than prime, the average rate of farm loans also rocketed to a 20-year high. As inflation settles and rate hikes cease, many farmers are now looking for ways to lower their rates.

Challenge

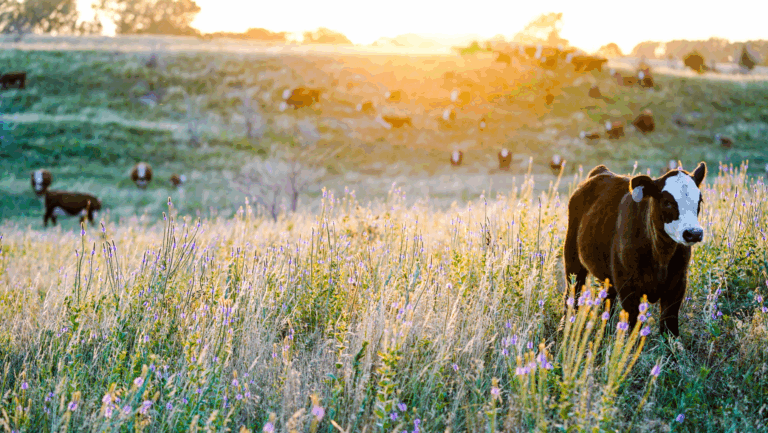

A multi-generation cattle farmer fell on hard times years ago and, as a result, had trouble making loan payments. Even after he improved his financial situation and credit health, he was still feeling the ramifications of those hard times—namely, he was being held back by a loan with a very high rate.

Solution

An AgAmerica Relationship Manager learned of the farmer’s situation and visited his operation to discuss how we might be able to help. During the discussion, we reviewed his balance sheet and found that the farmer had been undervaluing his land which was artificially inflating his debt-to-asset ratio. AgAmerica worked with the rancher to rebuild a more accurate balance sheet that reflected the actual financial health of his operation. Then we were able to refinance his loan, reducing his rate. He also secured a $150K cash out to boost his immediate working capital. The rancher was pleased with his new rate and grateful to finally have a team on his side.