Family Farm Consolidates Debt and Secures Capital with $13MM Package

Vertically integrated operation in New Mexico hedges against future uncertainty with $5MM RLOC.

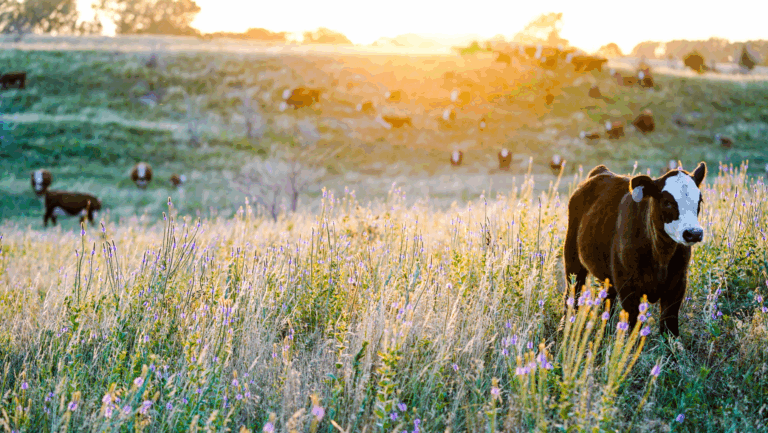

American farmers have the unique ability to recognize and implement safeguards against potential risks before they become larger issues. Severe weather, volatile commodity prices, and global trade tariffs are all examples of risk factors outside of the farmer’s control. Proving their resilience time and time again, American farmers stay a step ahead of these challenges and take a proactive approach to risk management in order to keep our food supply chain strong.

The Challenge

A multigenerational operation in New Mexico had been hit with excessive drought conditions ranging from severe to extreme conditions for decades. The ongoing risk of drought and volatile commodity markets motivated them to improve their operational resilience over the years through crop diversification, drip irrigation systems, and precision ag technology. Along with these improvements, they became a vertically integrated operation—meaning they were responsible for the planting, harvesting, and packaging of a variety of commodities shipped nationwide. As their farm profit margin bounced back from adverse weather and suppressed prices in 2018, the family sought alternative financing to consolidate existing debt obligations and enhance the financial structure of their operation for continued improvement.

The Solution

With a customized $8MM term loan package, AgAmerica was able to consolidate existing debt obligations and provide an additional $5MM revolving line of credit for operational expenses as needed. Through this strategic consolidation, the borrowers were better positioned to recapitalize their operation, effectively manage cash flow with a flexible line of credit, and improve their financial footing for eligibility thresholds in the future.