How Farmers Can Prepare in the 2023 Agricultural Economy

AgAmerica’s annual economic report is here and predicts a positive outlook for the U.S. farm economy in 2023—but elevated risk remains.

American farmers and ranchers ended 2022 in strong financial position, despite higher production costs and lower government funding.

The U.S. Farm Economy

Looking Back: A Rearview Look at 2022

Net Farm Income

(+13.8%)

Production Cost

(+18.8%)

Net farm income is projected to reach a record in 2022, with a 13.8% nominal increase from 2021. This increase is largely led by higher cash receipts.

Total Cash Receipts

(+24.3%)

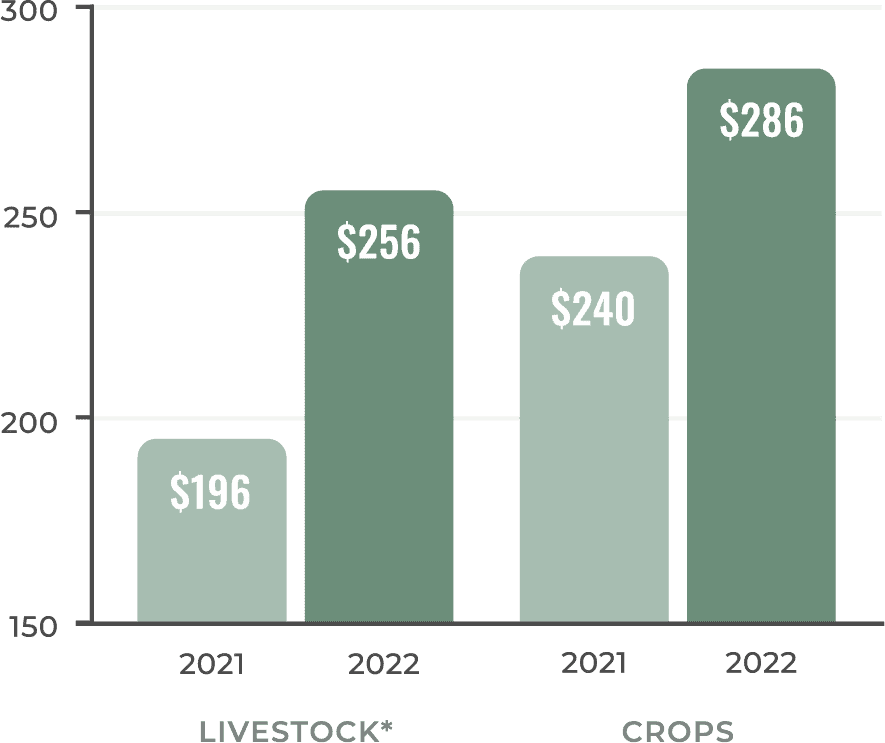

Total Cash Receipts

(by million U.S. dollars)

Crops

LIvestock*

Higher cash receipts in 2022 were partially offset by higher production costs and lower direct government payments.

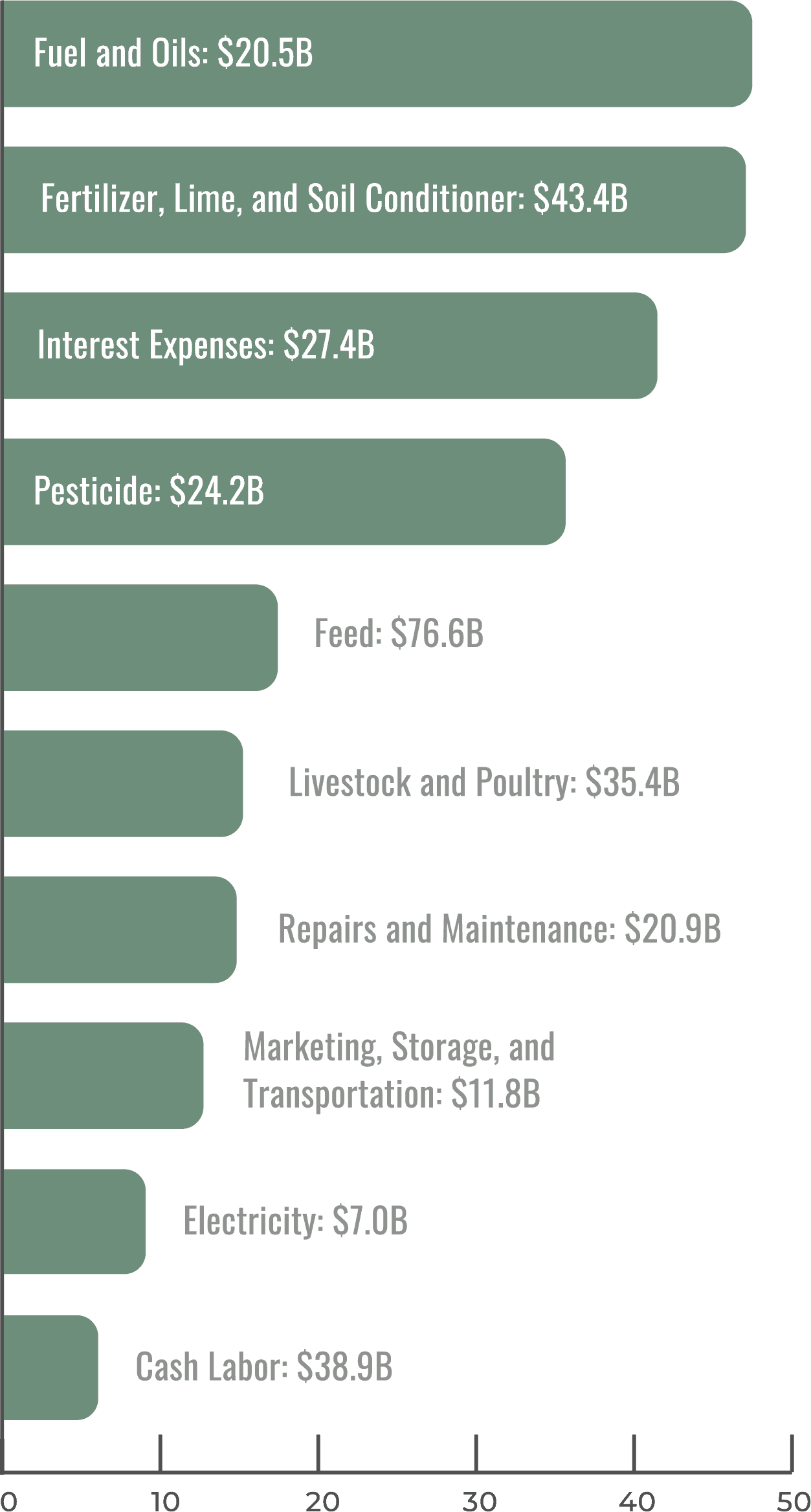

Input Price Increase

(by percentages)

Supply chain bottlenecks and geopolitical affairs caused input costs to rise across the board—outside of seed prices which saw a minimal decline of less than one percent.

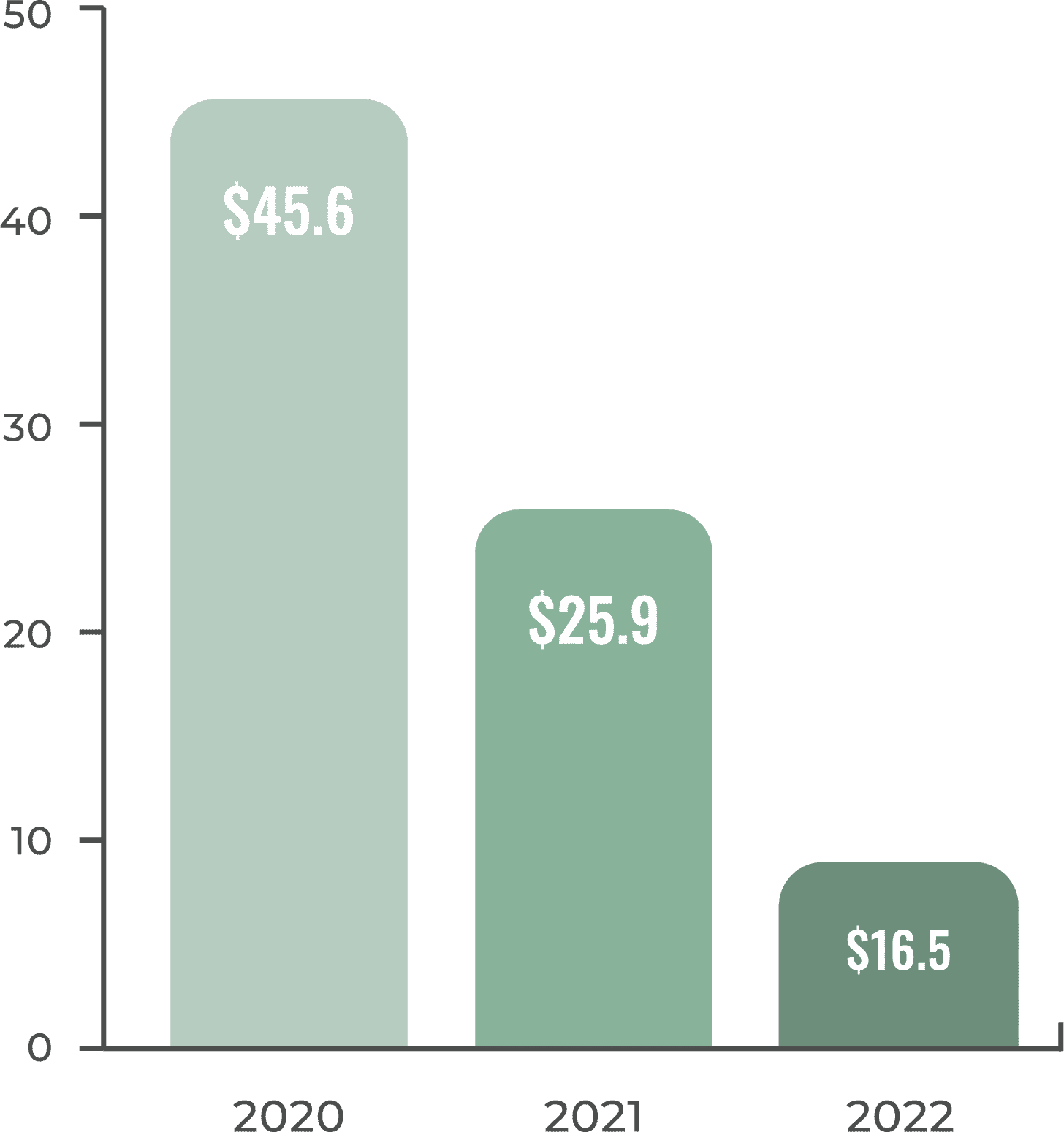

2022 Direct government payments

(-36.3%)

Direct Government Payments

(by billion U.S. dollars)

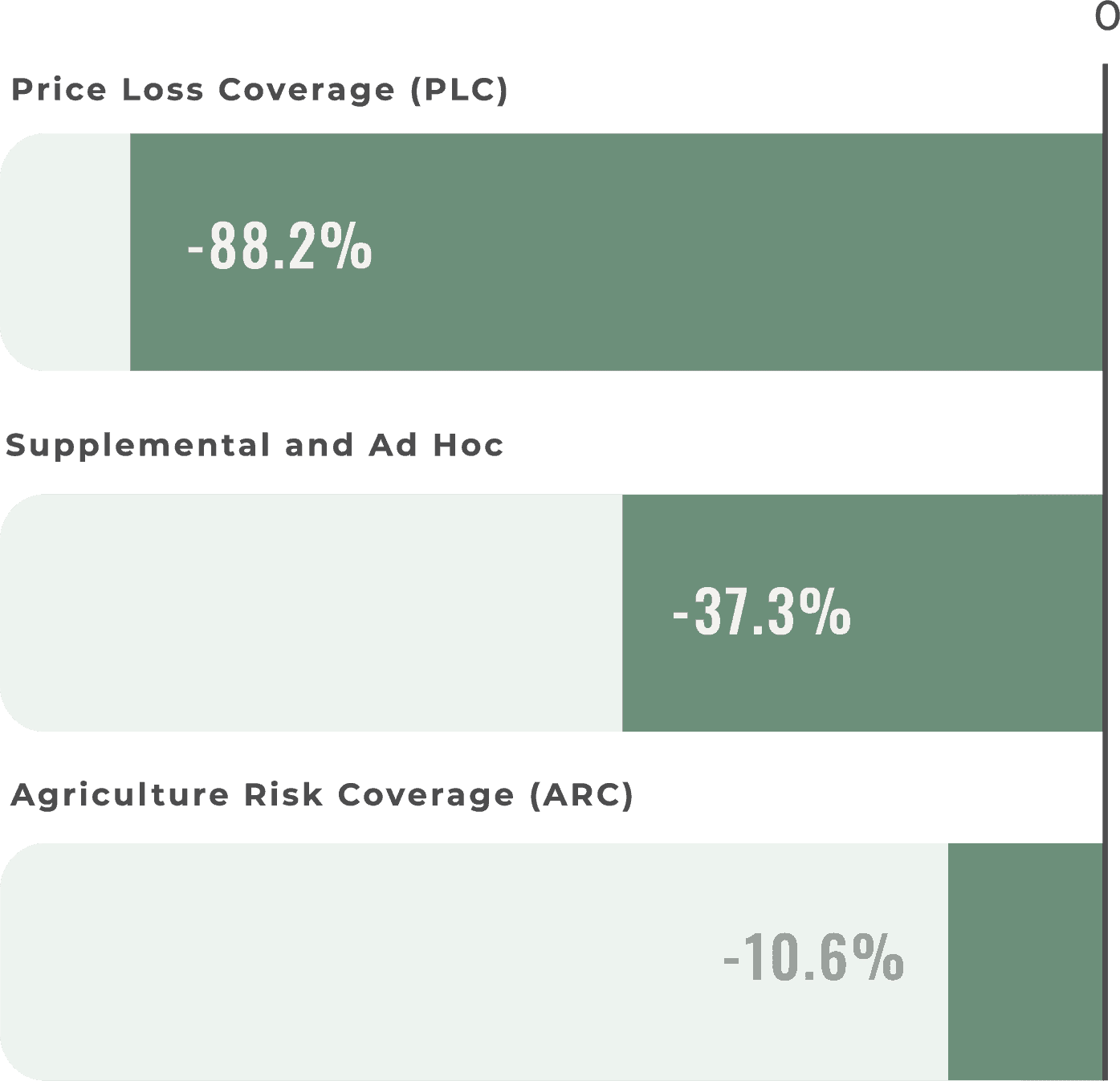

Sharpest Decline in Funding

(by percentages)

Program commodity prices stayed well about 2018 Farm Bill support prices, leading to a substantial drop in PLC payments in 2022.

The only agricultural funding programs that saw an increase in direct government payments were conservation programs, with an 18% increase from 2021.

Bottom Line

Despite higher cost of production and less federal assistance, net farm income trended in the right direction in 2022 and put the U.S. farm economy in a favorable position as we head into 2023.

Total cash farm receipts increased more than 24 percent from 2021 to 2022, offsetting higher costs and leading to a healthy appreciation of assets. Total assets in the farm sector rose 10 percent in 2022, reflecting the 14.3 percent increase in cropland values and 11.5 percent increase in pastureland values nationwide.

Chief Economist Dr. John Penson has been monitoring the economic landscape of U.S. agriculture throughout 2022 and has identified the top three risks farmers face in 2023 in AgAmerica’s annual farm economy report, The Economic Outlook for U.S. Agriculture in 2023.

Navigating the Top Three Risk Factors in the 2023 Farming Economy Outlook

There are several factors clouding the 2023 outlook for the U.S. economy, including the continuation of supply chain disruptions, higher interest rates, the likelihood of a recession, and more.

For the American Farmer, here are the top three contributing factors that will ultimately impact their bottom line in 2023.

1. Commodity Prices

Increased variability in commodity prices combined with the cyclical nature of the industry mean prices will likely soften over the course of 2023, placing a premium on good marketing skills.

Pro tip: Generally, producers will combine futures contracts, or forward contracting, with periodic cash sales in the case of nonperishable commodities to manage price risk. If spreading cash sales of nonperishable commodities, don’t wait too long expecting some event that might increase prices. Prices of commodities held in reserve can fall.

2. Production Costs

Nearly every farmer in the U.S. felt the squeeze higher input costs had on profit margins in 2022 in one form or the other. The bad news is supply chain disruptions will likely continue in 2023, keeping costs elevated. The good news is that the rate of price hikes is expected to slow compared to what was seen over the last two years.

Pro tip: Waiting until next spring on the hope that input prices like fertilizer might fall comes with the risk that prices may be higher and, in some cases, inputs unavailable. Forward pricing of seed, chemicals, fuel, and feed acquisitions can be used to avoid unwanted surprises. You might also consider keeping an inventory of spare parts normally needed during the year rather than run the risk of them not being available locally when you need them.

3. A Recession

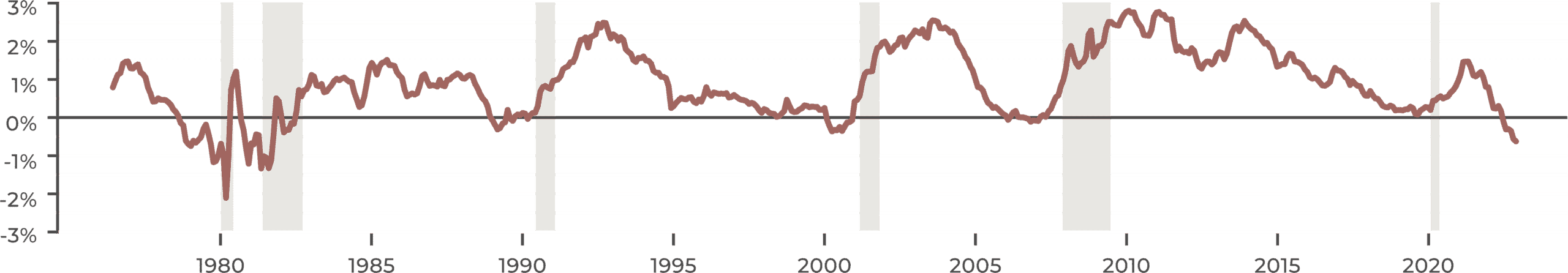

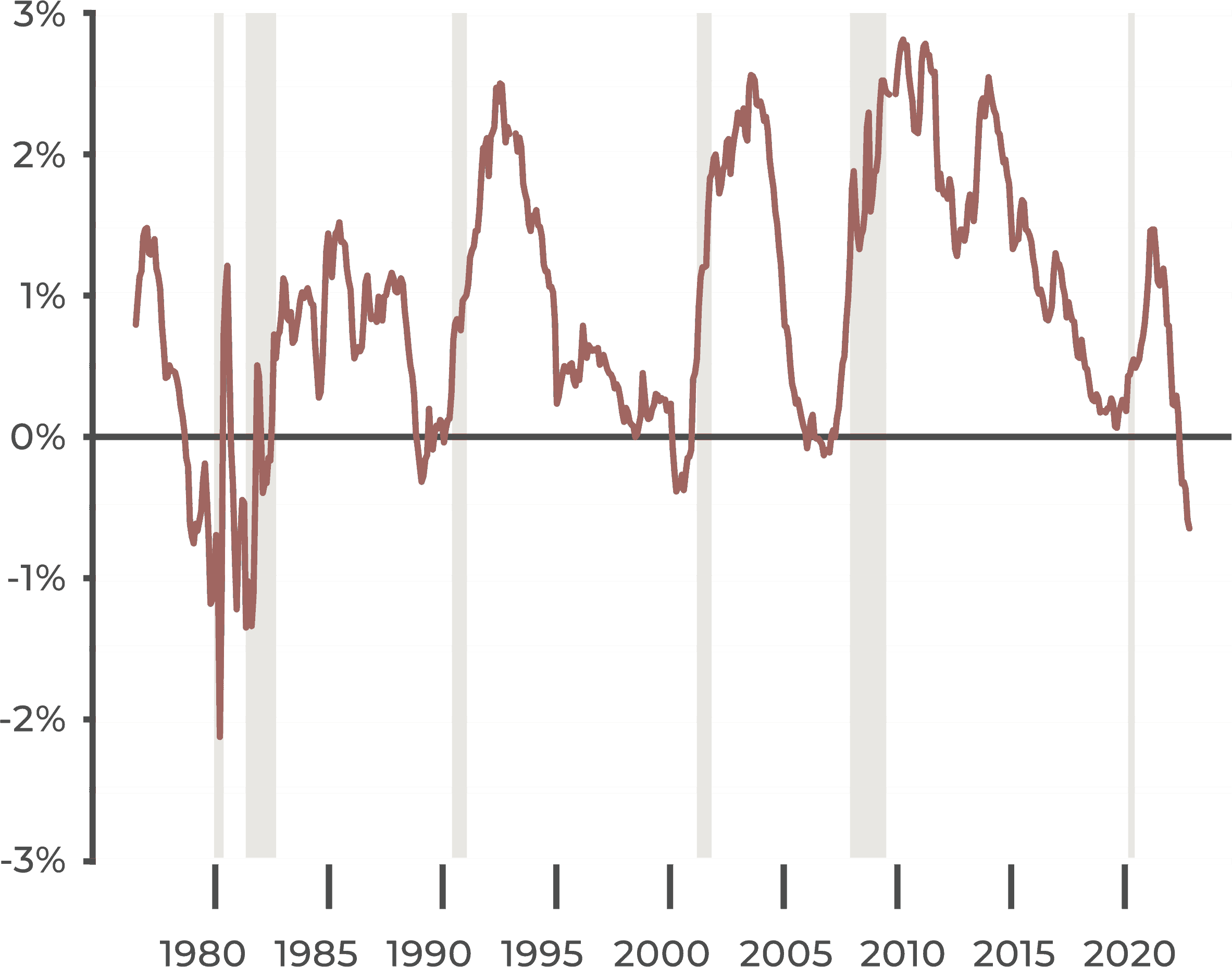

The 10-year Treasury rate was trading below the two-year Treasury rate in late 2022, reflecting increased uncertainty about the economy in the longer run. This inversion of these yield trends, the largest such spread since 1981, has signaled the last five major U.S. recessions.

10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity

(percent, monthly, not seasonally adjusted)

Source: Federal Reserve Economic Data

So, if a recession was to occur, how would that impact U.S. agriculture?

Unfortunately, there isn’t a definitive answer to this. The impact of a recession in the current farm economy would depend on region and type of operation. It would also depend on the length and depth of the recession itself.

For example, a mild recession that lasts two to three quarters would have a minor impact on agriculture. But a more protracted recession would affect export demand and domestic consumer spending.

Even so, ag would not suffer as much as other sectors, such as the service economy and construction. If net farm income were to decline due to a recession, it would most likely be through international effects—such as export sales—rather than a loss in real estate values.

Pro tip: In times of an economic downturn, cash is king. It is recommended that operating costs comprise 30 percent or less of total liquidity. If it exceeds this, additional capital may be required to keep your operations secure, in the form of a line of credit, debt restructuring, or equity cash out. Liquidity also provides flexibility in negotiating prices for inputs. A negotiated line of credit or refinance to lower loan payments can help you manage liquidity needs.

Of course, there are more than three factors generating risk for farmers and ranchers in 2023. Download the full report to learn more about the outlook for other influential factors at work—including weather, trade, and more.

Prepare for What You Can and Manage Your Farm Liquidity with AgAmerica

In a shifting economy, having a safety net of capital to ride the tides of change is key. Having a lender with the flexibility to adapt your financing to the ebb and flow of the farming economy is one of the greatest advantages you can have in a volatile market.

Learn how the AgAmerica Pivot™ program empowers farmers with greater financial freedom in times of uncertainty by providing short-term liquidity relief with the flexibility to adapt to a more long-term financial structure when the time is right. Try our free interest-only loan calculator to see how much you can save.