Four Barriers of Farm Succession (and How to Overcome Them)

Farmland is disappearing and the average age of the farmer is on the rise—do you have a farm succession plan in place?

From 2001 to 2016, the United States lost or compromised 2,000 acres of farmland and ranchland every day. Excessive regulations and industry challenges are making it more challenging for farmers to keep their land, resulting in a farmer pipeline problem. The average age of farmers continues to rise without enough young people entering the field to ensure a smooth transition. This poses a serious threat to the future of American family farms and ultimately compromises our domestic food security.

This unsettling reality leads us to ask—what are the barriers of entry for the next generation and what can farmers do to ease them?

In this article, we break down four barriers to farm succession and outline the different strategies we can use to tackle them.

1. High Cost of Entry

Only eight percent of farmers are under the age of 35. Land is expensive, especially when acreage gets into the triple digits. Securing financing for these transactions can be difficult, and many young people have not had the time to accumulate the wealth and credit score needed to overcome the cost of entry.

Even for farmers that are planning on inheriting land from their parents, they may still find themselves burdened by estate tax. The combined exemption limit for married couples is $23.16 million. As it stands in 2023, the sunset provision of the current tax law indicates this exemption could be cut in half if a new estate tax law is not passed. If the farmland, equipment, equity, and retirement funds total more than the exemption limit, heirs may be required to pay a 40 percent tax. Fortunately, tax burdens can be alleviated with proper estate planning to make the transfer of ownership more seamless.

Beyond taxation, many young farmers use government grants, loans, and programs specifically designed to support young farmers to overcome the initial upfront cost. These resources can provide financial assistance for land purchases, equipment, and operating expenses.

Young farmers can also begin their careers by leasing land or participating in collaborative farming, where they share resources and land with more established farmers.

2. Lack of Affordable Childcare

As many as 74 percent of farm families are affected by childcare challenges, including high costs, limited availability, and long commutes. These constraints not only impede farm growth but also force farmers to choose between expanding their businesses and ensuring the safety and well-being of their children.

Fortunately, the American Farm Bureau Federation and the National Farmers Union have made affordable childcare a key priority in their agenda for the 2023 Farm Bill. This marks the first time that childcare affordability has been included in the organizations’ collective focus, highlighting its growing significance in the agricultural sector.

The groups have introduced a bipartisan bill—the Expanding Childcare in Rural America (ECRA) Act of 2023. The bill aims to improve the availability and quality of childcare in rural areas while also making it more affordable.

3. Hard Conversations and Assumptions

In a survey conducted by AgAmerica in 2015, nearly half of the respondents said they have multiple generations working on their farms. More than 38 percent planned on selling or transitioning the farm to the next generation, and nearly 70 percent said they planned on making that transition by 2025.

It’s clear that farmers have a desire to pass on their operations to the next generation, but only 23 percent have a plan. Succession is a family matter—and a business decision. Mixing those two realms often means tackling difficult conversations, like retirement, letting go, and fairness between siblings. Almost 14 percent of farmers cited “tensions created within the family” as a top concern when transitioning the business.

As hard as those conversations can be, the other option is to risk losing the family farm due to a lack of planning. It’s important for both generations to create an open dialogue about their expectations and wishes for the future. The earlier you can have these conversations, the easier transition of ownership will be.

Young farmers should communicate their life goals, and where they see themselves in the farm’s future, as early as possible. Likewise, retiring farmers should be honest about their retirement plans and how they plan to transfer ownership of the farm.

4. Lack of Support for Farm Succession Planning

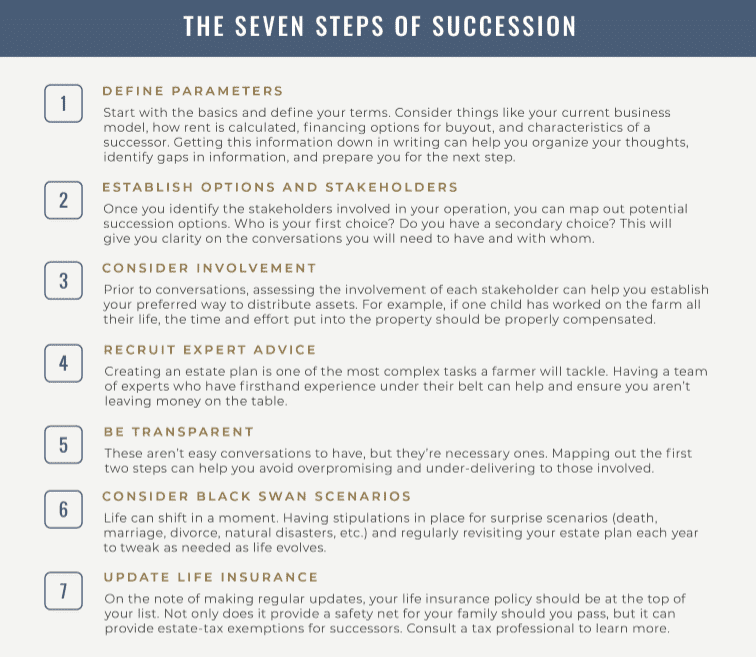

It’s never too early—or too late—to start creating a farm succession plan. But it can be an overwhelming task to tackle on your own. Here is a high-level glimpse into what the planning process looks like to get you started on the right foot.

Creating a farm succession plan is a complicated process. You must navigate legalese, tax burdens, financial planning, and family dynamics. That’s why many farmers seek help from experts, like financial planners, lawyers, and lenders during this process to ensure they create a farm succession plan that can withstand the test of time.

“We didn’t want our farm to transition in crisis. And we didn’t want our farm to transition out of necessity, we wanted it to transition because it was planned, because it was best for the business, because it was best for the family and all of our team members. So we put a lot of thought into it, and my final sticking point was that I really wanted to hire a consultant to help us. I didn’t think we could do it on our own.”

Michelle Sirles, Illinois farmer

Get the Conversation Started Today

Starting the conversation is the first step to ensuring the legacy of your family farm stays intact. To support you through this process, AgAmerica consulted with a national wealth advisory firm to create a whitepaper that can help farm families through the farm succession plan process. Download for free today to start the conversation of keeping your legacy alive.