Improving Farm Profitability: Input Costs, Crop Yields, and Risk Management

Running a profitable farm involves navigating both unpredictable and controlled factors.

The characteristics of highly profitable farms are difficult to estimate, but not entirely incalculable. While there are circumstances beyond the farmer’s control—such as weather, regulations, market prices, and trade policies—the business decisions made by farm operators can have an equal or even greater impact on farm profit margins.

Manageable characteristics that contribute to farm profitability include:

- Farm input costs;

- Crop yield metrics;

- Ag tech adoption rate;

- Risk management; and

- Farm size classification.

Each of these factors can be systematically measured, classified, and adjusted to improve farm profit margins. However, as with most things, it is not a simple one-size-fits-all approach. Characteristics of high-profit farms vary depending on region, commodity, and soil health.

In this article, we discuss the main factors that contribute to farm profitability and strategies to improve your operation for future generations.

Input Costs

Input costs and crop yields go hand in hand when making business decisions for your agribusiness. It’s imperative to do market research for any new endeavor in order to identify which one works best for your particular operation. It’s important to factor in everything from crop profitability in your region to the implementation of new technology. Maintain communications with input suppliers to ensure inputs align with farm management plans and that all purchase opportunities are being utilized, such as bulk ordering and forward purchase contracting.

Whether you’re interested in diversifying your crops or growing your own livestock feed, monitoring performance and conducting KPI audits provide the data needed to make informed decisions. Key performance indicators farmers should keep in mind include:

- Operating profit margin: measures the profit made after necessary input costs and before interest or tax.

- Asset turnover ratio: a type of efficiency ratio that measures the value of farm sales relative to existing farm assets.

- Return on assets: an indicator of farm profitability generated from assets that is expressed as a percentage.

- Return on equity: a measure of financial performance calculated by dividing the net farm income by the equity owned minus debt.

- Sustainable growth rate: the maximum rate of growth for a farm over the long-term.

Being detail-oriented and documenting progress allows you to strategically adapt your business plan as needed and could be the difference between barely scraping by or having a safety cushion when unpredictable factors strike.

Crop Yields

Knowing when, where, what, and how much to plant is an art among farmers and requires in-depth research of past planting trends that are specific to your subregion. For example, northern and central Illinois planted more acres of soybeans than corn from 2015 to 2019, while the opposite was true for southern Illinois, according to data from the Illinois Farm Business Farm Management Association (FBFM). Beyond state and regional differences, subregional differences exist within states and merit consideration.

A few strategies high-profit farmers use to improve crop yield year over year include:

- monitoring market fluctuations with a plan to adapt;

- improving soil health and weed management practices; and

- Integrating sensors and IoT technology to monitor crop health.

Highly profitable farmers know their land and like the back of their hand, scouting fields throughout the season to ensure their operation is set up for success. Proper documentation of crop yields and input costs gives farmers the insight needed to improve and expand the profitability of their operation.

“You’ve got to become a student of your crop, right? You have to be out there evaluating, understanding. What are some of the yield-limiting factors that I see? And if I see those, can I address them now for this season, or is it something I’ve got to look at for next year?”

Matt Essick, Agronomist.

Ag Technology Adoption

It’s a simple formula, low overhead plus optimized production equals higher profit margins. This fundamental rule leads to the other influential factors that answer the question that is perpetually on the minds of farmers across the nation: how can I make more money farming?

Reducing cost is only the tip of the iceberg. Lower input costs can still equal lower profit margins if crop productivity declines along with it. The real goal is to widen the gap between crop yields and input costs by increasing production at minimal cost. Sometimes, higher initial investments in technology lead to higher long-term growth and profitability. Historically, there has been a focus on volume over efficiency. The rise of farm tech has shifted this thinking from “produce more” to “produce more efficiently”.

A growing number of farmers are improving farm profitability through precision ag tech. Whether it’s installing a new drip irrigation system or using automated robotics to lower farm labor expenses, high-profit farmers embrace the learning curve that comes with precision ag technology. This learning curve equips them with the ability to make more educated decisions on need and capacity. This growth in operational awareness is rewarded with higher yields and a capital investment that pays for itself over time. Through these technological advancements in agriculture, total farm output in the U.S. tripled between 1948 and 2017, even as the use of farm labor and land declined.

Risk Management

Farm risk management strategies provide a hedge against unpredictable factors that shrink farm profit margins. Accurate value tracking of crop yields and input costs contribute to increased efficiency. Crop insurance prevents the crops you work hard to grow from being at the mercy of the forces of nature. Forward price contracting does the same thing by easing risks associated with a volatile market future.

A sound risk management strategy protects farms from catastrophe during the tough years while equipping farmers with the ability to thrive during good economic times.

Farm Size

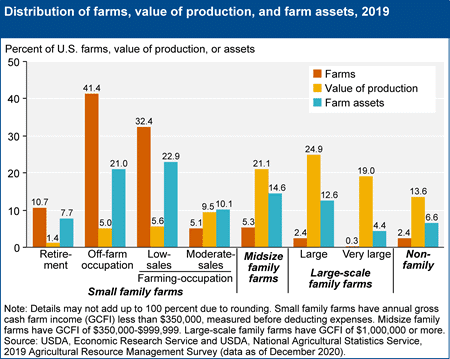

According to a recent USDA report on farm structure and diversification, high-profit farms disproportionately fall into the large-scale farm category. Large farms can spread labor and machinery costs over more acres, in turn, lowering input costs and increasing profitability per acre. This is also a contributing factor to farm consolidation trends, as smaller farmers are finding it more difficult to compete with large-scale operations while earning a living wage without supplemental off-farm income. In fact, nearly 42 percent of small family farms in the U.S. depend on off-farm income to continue production. Many have transitioned to more niche farming methods, such as agritourism operations and direct-to-consumer models, to set them apart from their large-scale counterparts.

Small family farms account for 88 percent of all U.S. farms and contribute 19 percent of total U.S. ag products sold. Comparatively, large-scale farms represent three percent of U.S. farms and account for 43 percent of total ag output. To overcome this pressure of consolidation, more farmers are investing in precision ag technology to reduce input costs and increase production rates.

Flexible Financing to Evolve with Your Farm’s Future

All too often, farmers lack access to the capital or resources needed to establish a more profitable and resilient operation. Recognizing the need for adaptable financing that can evolve along with a complex industry, AgAmerica stays committed to providing a spectrum of lending solutions that meet the immediate needs of farmers nationwide and can adapt along with them.

If you would like to learn more about working with a lender who understands the intricacies of financing a farm operation, contact one of our land lending specialists today to discuss your business goals and let us help you grow.