Understanding Historical Farmland Market Trends

The farmland market is an important indicator of an operation’s financial strength.

For farmers who own their land, farmland makes up more than 80 percent of their total assets. Historically, farm values have held steady in the face of economic turbulence, making them an effective risk management tool during market fluctuation. Understanding farmland market trends can help you make more informed decisions for your operation and effectively use farmland ownership to your advantage.

In this article, we explore historical farmland market trends, including farmland ownership demographics, average farm sizes, and regional differences.

Who Owns U.S. Farmland?

Many Americans believe the majority of farmland in the U.S. is owned by mega-corporations. In reality, nearly 98 percent of U.S. farms are family-owned. It is also less common for American farmland to be owned by someone outside of the agriculture industry. Over 75 percent of farmland in the U.S. is owned by an active operator or a retired farmer.

In recent years, there has been growing concern about foreign ownership of U.S. farmland. In 2023, foreign entities owned 40.8 million acres of U.S. agricultural land. Canada is the largest contributor to this number, accounting for a third of all foreign-owned land (or 13.6 million acres). In comparison, China owns 347,000 acres.

This number accounts for a small percentage of farmland in the U.S., but it has been steadily climbing—increasing 66 percent since 2010. If the number continues to grow, it could spell financial trouble for native farmers by inflating farmland prices. This reality has also triggered concerns about what this could mean for our national food security. In response, an increasing amount of legislation at both the state and federal levels has been introduced to limit foreign ownership of American farmland.

Farm Sizes Vs. Farm Production

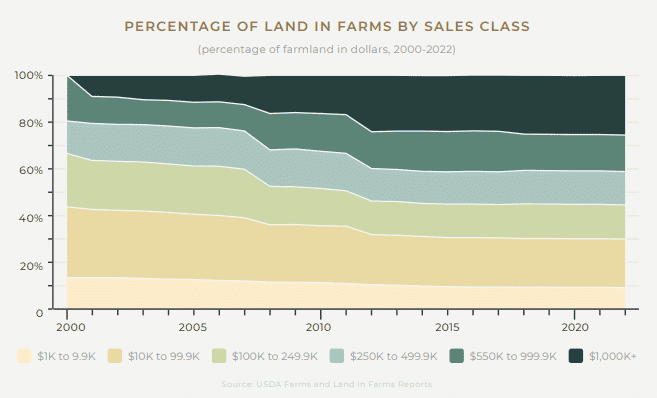

Although nearly 90 percent of farms are considered “small” (an operation with gross cash farm income under $250,000), they only produce 18 percent of America’s agricultural products.

Operations are getting larger. Since 2000, upper-midsize farms have grown in both shares of total farms and land in farms. This could be following a trend of consolidation that began in the 1970s, when the USDA Secretary, Earl Butz, coined the infamous phrase “get big or get out.”

The trend toward consolidation was further hastened by the 2008 global recession, where decreased global trade and repressed commodity prices made it very challenging for small farms to thrive. At the time, larger operations had the advantage of economies of size, allowing them to outproduce their smaller competitors and weather the lower commodity prices.

Regional Differences in Farmland Market Trends

It’s important to note that national farmland valuation trends are averages, which can mask huge differences in prices among regions and states. Many factors contribute to this, including soil quality, annual rainfall, proximity to markets, and much more.

The chart below explores changes in farmland values between 2010 and 2023. For cropland, the Northern Plains region saw the most growth, due to strong soybean and corn commodity prices. The same can be seen for pastureland, with the Northern Plains seeing the most growth.

| Cropland | Pastureland |

| Most expensive cropland per acre New Jersey: $18,100 California: $15,880 Iowa: $10,100 Illinois: $9,580 Delaware: $9,500 Highest percentage increase in cropland price year-over-year Kansas: 16.6% Nebraska: 13.8% New Jersey: 13.8% North Dakota: 13.2% South Dakota: 12.9% Most affordable cropland per acre Montana: $1,170 New Mexico: $1,810 Wyoming: $1,840 Oklahoma: $2,210 Texas: $2,590 Lowest percentage increase in cropland price year-over-year Montana: 0.9% New Mexico: 1.1% Oregon: 1.9% Washington: 2.0% Alabama and Mississippi: 2.1% | Most expensive pastures per acre New Jersey: $16,600 Florida: $6,500 North Carolina: $5,550 Tennessee: $4,900 Virginia: $4,650 Highest percentage increase in pasture price year-over-year Kansas: 16.2% Nebraska: 16.1% New Jersey: 15.3% North Dakota: 15.1% Florida: 10.2% Most affordable pastures per acre New Mexico: $490 Wyoming: $670 Montana: $800 Washington: $835 Oregon: $950 Lowest percentage increase in pasture price year-over-year Wyoming: 1.5% Louisiana: 1.8% Washington: 1.8% New Mexico: 2.1% Pennsylvania: 2.1% |

Pro tip: It’s important to remember commodity prices and input costs play a key role in farm income and therefore farmland values. When predicting future farmland values, it’s essential to take net farm income into account and the factors that affect it.

Take Advantage of the Booming Farmland Market

At AgAmerica, we’re committed to helping rural landowners succeed. Want to learn more about how to optimize your farmland and profits? Download AgAmerica’s free farmland report and unlock farmland market insights, forecasts, and more.