Understanding Your Credit Score and Farm Loan Options

When seeking financing for farmland, it is important to understand how your credit score can impact your farm loan options.

Credit scores measure the likelihood that a borrower will repay debts as agreed. Therefore, understanding how lenders use credit scores is helpful when farmers are interested in securing capital for their operation. Because AgAmerica is an alternative land lender, we have more autonomy than traditional financial institutions when it comes to our financing and use of credit scores. Before learning more about alternative financing options for farm loans with bad credit, let’s first establish the scale on which credit scores are evaluated.

Understanding Credit Scores

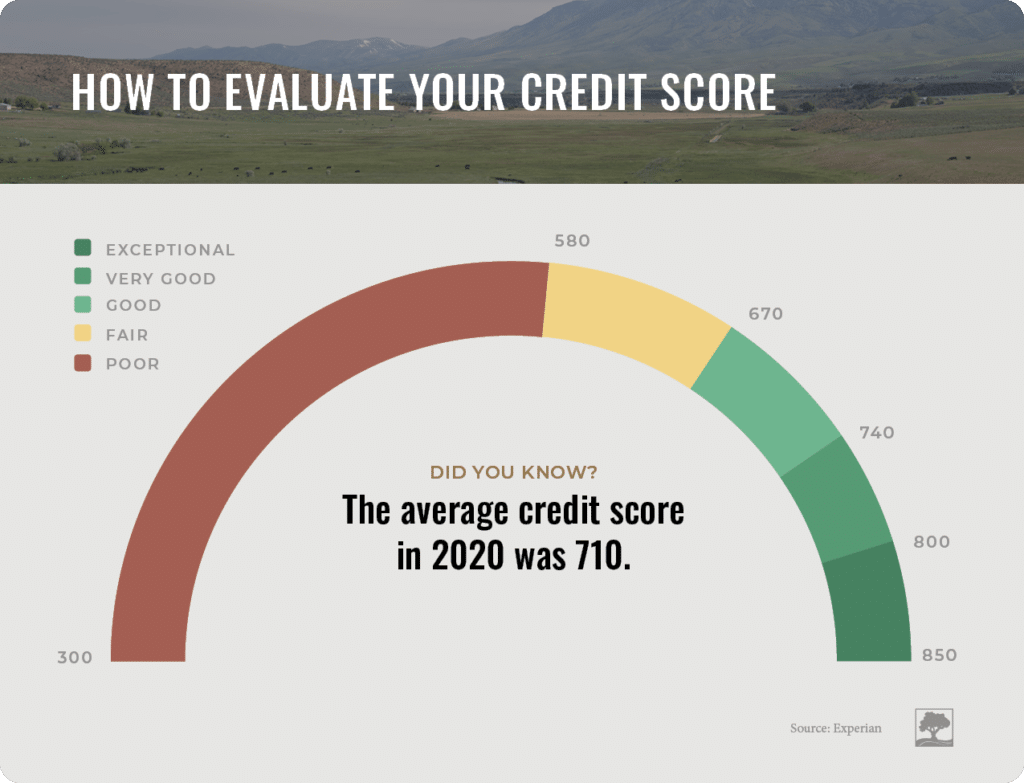

Fair Isaac Corporation (FICO) credit scores range from 300 to 850. The infographic below depicts the standard range of FICO credit scores and what they mean.

Lenders use this credit score range when determining credit risk and interest rates. Understanding what your score says about your credit history gives you a better understanding of the financing options available to you.

Factors That Affect Your Credit Score

At this point you might be wondering how credit scores are determined. The answer is that a variety of financial factors are taken into account. These factors include:

- Payment history;

- Total debt;

- Amount of available credit in use;

- Types of loans you’ve had; and

- Length of credit history.

Because farmers often cannot rely on consistent paychecks, upfront financing is an important tool for giving them timely access to working capital for input costs. While traditional banks often lack options for borrowers with low credit scores, AgAmerica offers alternative financing solutions.

AgAmerica’s Flexible Farm Operating Loans

As an alternative land lender, AgAmerica’s loan services are not restricted by the confines of traditional lenders—providing AgAmerica with greater flexibility when building custom loan packages. Like most lenders, AgAmerica sets a minimum credit score for many of our loan packages. For most AgAmerica loans, the minimum credit score requirement is 680, which is below the national average credit score. However, our Relationship Managers speak with each farmer on an individual basis to learn more about their unique needs and financial history. As a result, exceptions to the credit score minimums can be made on a case-by-case basis with our custom loan packages. Speak with a Relationship Manager to learn more about minimum credit score requirements.

Securing Transitional Farm Loans with Bad Credit

One solution when experiencing financial difficulty could be AgAmerica’s transitional farm loans, which provide a short-term solution for borrowers with lower credit scores who often wouldn’t qualify for conventional loans. These interest-only loans can provide immediate cash flow relief to rebuild a more financially resilient operation. In addition, they provide flexible use of funds to empower farmers to make the best decisions for their operations.

We understand that the needs of farmers change over time. As such, AgAmerica’s transitional loans are designed to evolve into a conventional loan with lower interest rates once you get back on your feet and gain some financial traction.

Farmer Returns to AgAmerica to Transition Short-Term Loan into Conventional Operating Loan

After using alternative financing to expand and strengthen the financial health of their vertically integrated operation, a first-generation farmer returned to AgAmerica to restructure existing debt. The farmer was able to transition debt into a blend of a conventional term loan and a revolving line of credit. In doing so, they lowered their payments and secured flexible working capital to support the continued evolution of their operation.

Don’t Let Your Credit Score Hold You Back

AgAmerica realizes that farmers and ranchers have a range of credit scores due to circumstances often out of their control. At AgAmerica, we believe potential can’t be measured by a number. Learn more about our flexible land loan spectrum by contacting a Relationship Manager.

There’s more to your financial health than just your credit score—explore AgAmerica’s free Financial Health Check tool today to evaluate your operation’s financial health.