Farm Income News: Net Farm Income Falls Below the 10-Year Average

Explore key findings from the USDA’s first 2024 farm income forecast report and why they matter.

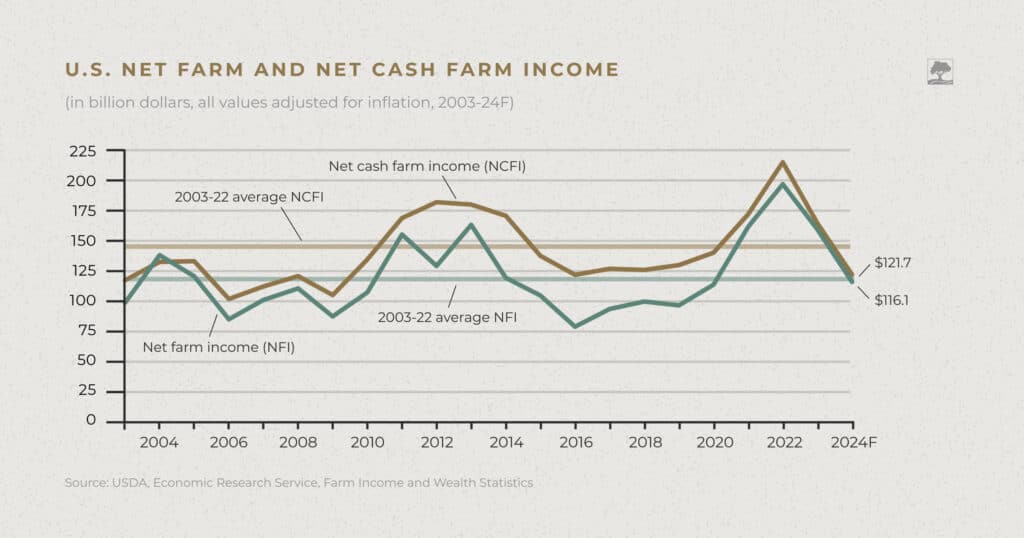

Farm income news was front and center last week with the release of the USDA’s first farm income forecast report in 2024. The report predicted a $39.8 billion decline in farm income—a drop of more than 25 percent. This is the largest year-over-year decline in income the agriculture sector has seen, if realized. Net farm income would fall to $116.1 billion, placing it just below the 10-year average.

In this article, we’ll dig into what factors are influencing farm income in 2024 and what farmers can do to weather it.

Factors Influencing Net Farm Income

Direct Government Payments

Direct government payments are forecast to decline nearly 16 percent to a total of $10.2 billion in 2024. Funding from supplemental and ad hoc programs, like the Livestock Indemnity Program (LIP) and the Noninsured Crop Disaster Assistance Program (NAP) is predicted to decline compared to 2023.

Many farmers are hopeful that the 2023 farm bill will include more funding for important programs like crop insurance. But with the farm bill still on hold, many government programs are locked into budgets established by the 2018 bill.

Production Expenses

Production expenses are predicted to increase nearly four percent to $455 billion in 2024. As we move even further from COVID-era challenges, the top spending categories for farms are changing.

| Top Three Spending Categories | |||

| 2023 | Fertilizer and Chemicals High oil prices inflated the price of fertilizer and chemicals in 2023, but that has since come down. | Labor Labor costs climbed higher in 2023, increasing almost two percent from 2022. | Interest Costs Federal rate hikes drove interest costs up to twenty-year highs, but rate cuts are expected in 2024. |

| 2024 | Feed The largest single expense category, feed is forecast to cost farmers $80.6 billion in 2024. | Labor The cost of labor continues to climb, rising 7.4 percent to $47.4 billion. | Livestock Purchases Livestock and poultry expenses are projected to slow down in 2024, but still increase by eight percent. |

Cash Receipts

Farm cash receipts are predicted to decrease by 4.2 percent to $485.5 billion in 2024. Corn and soybeans are affecting the total decline the most due to trade disruptions and competition from South America. Their combined prices are predicted to fall $17.2 billion. Across all crop cash receipts, the USDA predicts an eight percent decline.

Animal products are forecast to decline four percent. Turkey will see the largest decline, falling 21 percent. Turkey is falling from historic highs after the avian influenza killed more than five million turkeys in 2022, causing an increase in prices.

Some commodities will see an increase in prices, including fruit and nuts, cotton, and timber.

Farmers Should Pay Close Attention to Land Values

Lower net farm income places operators in challenging positions, requiring them to adopt more conservative strategies. Working capital is forecasted to fall 16.6 percent in 2024, compelling many farmers to closely scrutinize their wants and needs and strategize ways to extend resources.

Debt-to-asset levels are predicted to worsen slightly as appreciation is expected to slow, ending a long trend of high land prices. Farmers who plan to refinance their debt should pay close attention to the value of their land to ensure that they do not overestimate their equity. It’s critical to work with a lender you can trust, and farmers should seek out financial institutions with an agriculture focus.

The good news is the federal fund rate has remained unchanged since July 2023. Most economists expect interest rates to remain stable and begin falling steadily in the second half of 2024.

Prepare for the Future with a Finance Team You Can Trust

AgAmerica has been helping farmers gain financial flexibility for almost two decades. We understand that agriculture is a volatile industry. We assist farmers in maintaining a healthy balance sheet, providing them with important counsel and financing as needed to weather changes in the economy.

Learn how we can help you prepare your operation. Contact us today.