Highest and Best Use Real Estate for Agriculture

When applying for an ag loan, it’s important to know how the value of your land will be determined.

Especially during times of rising farmland values, the relationship between ag loans and farmland values is important to understand. Because AgAmerica is a land lender, our loans are backed by the intrinsic value of your land. Therefore, determining the land’s value is a crucial part of the loan approval process.

AgAmerica sat down with Chief Appraiser Jim Pruitt to learn more about the land appraisal process. Jim earned the prestigious Real Property Review Appraiser accreditation from the American Society of Farm Managers and Rural Appraisers and has over 30 years of experience in the field. This accreditation certifies the highest level of expertise in appraisal reviews of complex properties or situations. Using his extensive knowledge and experience, Jim shares his firsthand insights on real estate appraisal and what farmers, ranchers, and rural landowners should know.

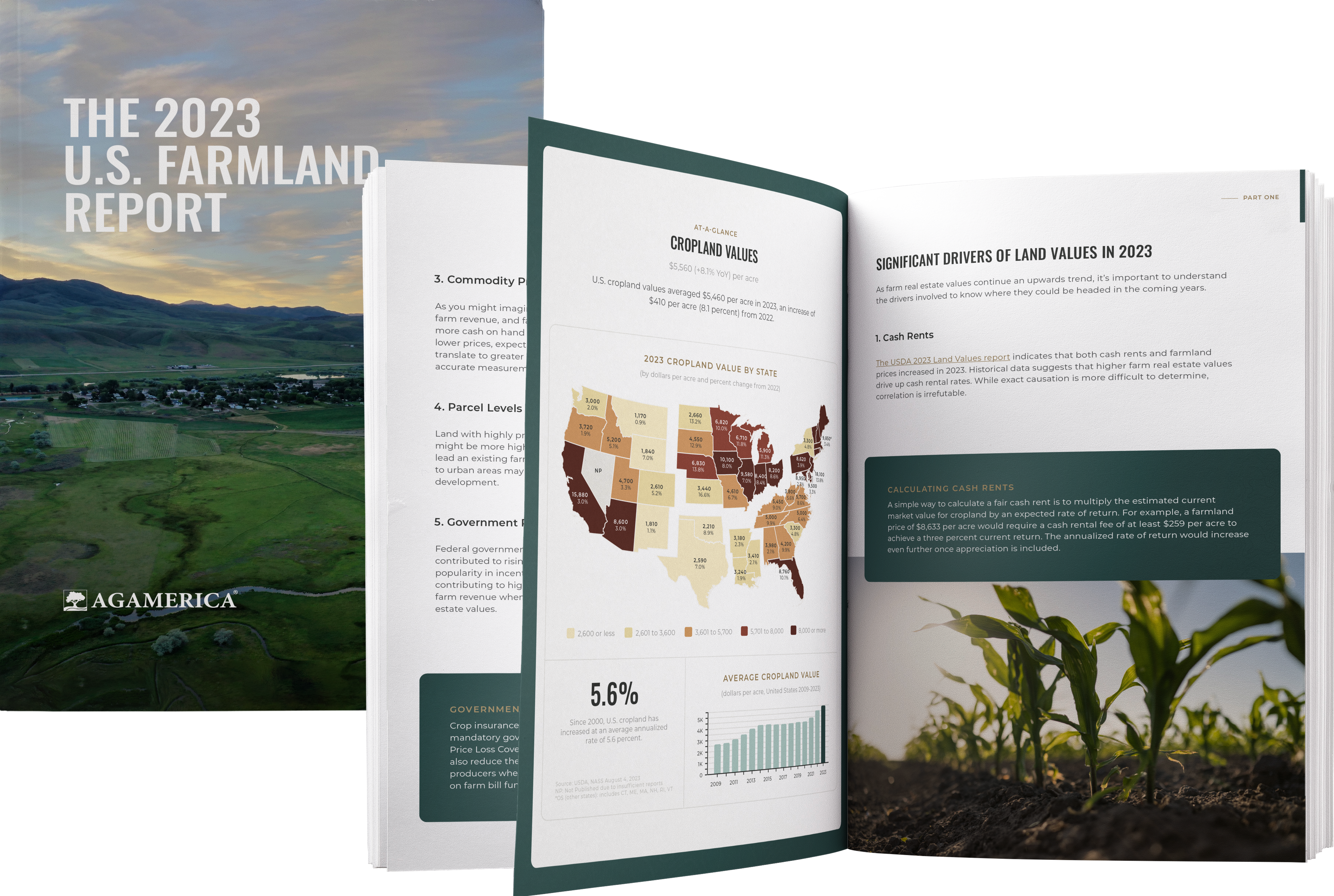

The 2023 Farmland Report

Understanding the power of equity is key in helping farmers mitigate financial risk. Download AgAmerica's free land report to unlock market insights from AgAmerica's economic research team.

The 2023 Farmland Report

Understanding the power of equity is key in helping farmers mitigate financial risk. Download AgAmerica's free land report to unlock market insights from AgAmerica's economic research team.

Understanding AgAmerica’s Appraisal Process

When first examining the appraisal process, it’s important to note that the appraiser must be unbiased, basing their assessment on facts and reputable research. This means that while the appraisal influences the loan structure, the loan structure does not influence the appraisal process in any way.

While AgAmerica will need to conduct an official appraisal (either in-house or with an external appraiser), it’s smart to come to the table with a general idea of how much your land is worth. Speaking with other farmers in your area and conducting research on similar land values can help you formulate a prediction.

When determining the value of farmland, AgAmerica’s appraisal considers factors including, but not limited to:

- Highest and best use of real estate;

- Previous sales of your property and the circumstances of those sales;

- Land value trends; and

- Sales of comparable land tracts.

“Highest and Best Use” Valuation for Agricultural Real Estate

When appraising agricultural land, the appraiser bases the land’s valuation on its highest and best use. The highest and best use of real estate helps to determine which data will be included in the official appraisal report used by AgAmerica’s underwriters. According to Jim Pruitt (and the Dictionary of Real Estate Appraisal 6th Edition),

“Highest and best use is the reasonably probable use of property that results in the highest value. This use must be legally permissible, physically possible, financially feasible, and maximally productive.”

Conducting a Highest and Best Use Analysis

Jim also explained how the particular use that the land’s value is based on must satisfy all four requirements of highest and best use real estate:

- Legally permissible: This aspect relates to zoning laws and ordinances, and/or deed restrictions. For instance, a conservation easement could restrict certain activities on the land. In terms of zoning, land use could be restricted based on what local governmental agencies approved it to be used for.

- Physically possible: This ensures the land can support a crop and which crop/s could be grown on it. For example, water-intensive crops would need land with access to sufficient irrigation.

- Financially feasible: This considers whether a profit can be made on the land. Your revenue will need to exceed your input costs. An example is if heavy irrigation must be used, its cost must be more than offset by cash receipts from the crop.

- Maximally productive: This indicates which use will lead to the highest value. After narrowing down potential uses from the first three tests, the appraiser determines which use would be the most profitable.

How Highest and Best Use Affects Land Value

After the highest and best use of the property has been established, the appraiser searches the local market for sales of properties with a similar highest and best use. For example, if your property is irrigated row crop land, it would not be appropriate to compare the sale of a dry pasture property to yours, even if it were close by. By comparing those sold properties to your property, the appraiser can establish an opinion of value that can be used to help structure your loan. As noted above, the appraiser will also consider market trends to ensure that older sales are considered correctly in the current market, and any recent sales of your property are also analyzed to provide an understanding of its history.

Leverage the Value of Your Land with AgAmerica

Now that you understand how your land is appraised during the loan approval process, you can come to the table prepared, knowing what to expect. Once your land is appraised to its highest and best use, AgAmerica’s underwriters begin setting up a customized loan that meets the unique needs of your operation.

Explore AgAmerica’s land loans to learn more about the spectrum of land financing available to you.