Report Highlights from the 2022 Farm Income Forecast

Learn more about farm income in 2022 and the factors impacting it.

The most recent USDA Farm Income Forecast predicts a net farm income increase of $34B (30 percent) from February’s projections due to increases in commodity values and cash receipts. In addition, the gap between net farm income and net cash farm income is expected to increase as a result of changes to cash and non-cash transactions. For instance, farmers are expected to sell 12.8 billion in production inventories, widening this gap.

Another key component to this report is that the ratio of cash expenses to gross cash income from farming is expected to reach 80 percent, up 10 percent from 2021. This attests to the sharp increase of production expenses and the inability of commodity prices to keep up.

AgAmerica dove into the USDA report to identify the top three factors impacting farm income in 2022—cash receipts, direct government payments, and production costs. But before we do that, here are a few more highlights from the farm income report.

September 2022 Farm Income Report Overview

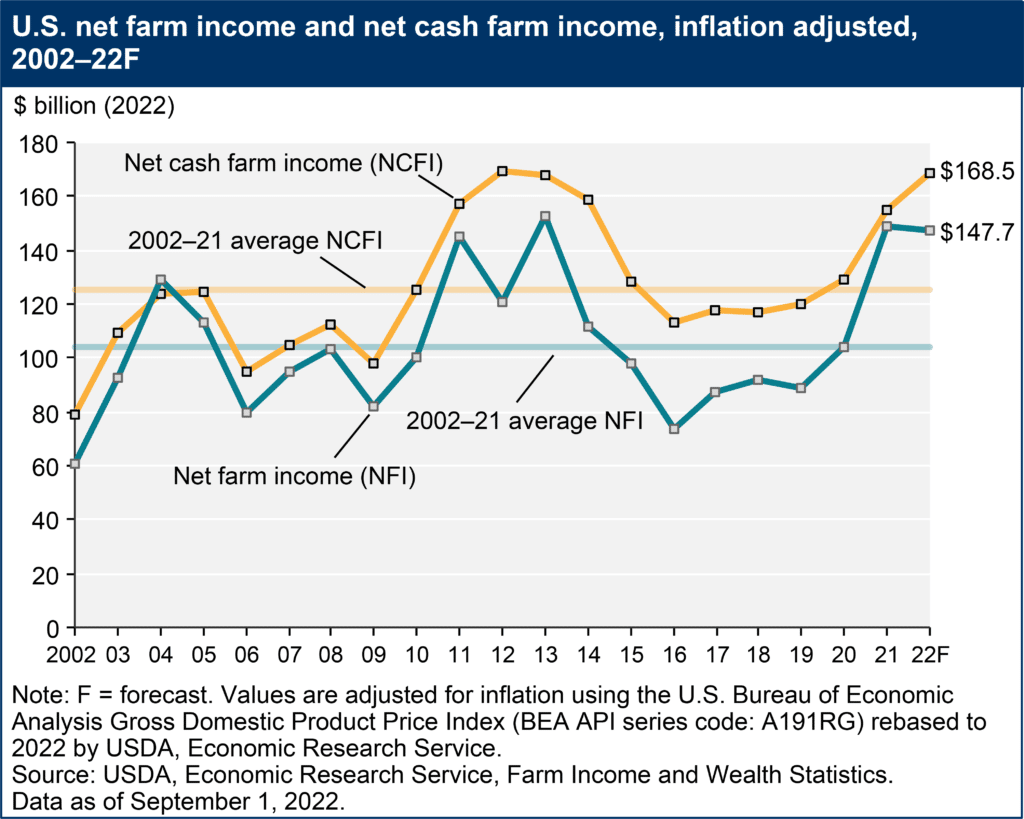

The USDA expects 2022 net farm income to reach $147.7B, an increase of $7.3B or 5.2 percent from 2021. However, when adjusted for inflation, 2022 net farm income is expected to decrease by 0.6 percent.

In comparison, net farm income in 2021 increased by 48.5 percent compared to 2020. Even though farm income continues to rise, the rate of this increase is hampered by continued rising production costs and fewer direct government payments.

Net cash farm income (excluding noncash items) is expected to reach $168.5B, an increase of $22.1B or 15.1 percent in comparison to 2021. In 2021, net cash farm income increased by 25.4 percent relative to 2020. This decline in the rate of increase for net farm income is likely due to lower direct government payments and higher input costs.

Even when adjusted for inflation, net cash farm income is still expected to increase by $13.5B or 8.7 percent, making it the highest it has been since 2012.

Top Three Factors Impacting Farm Income in 2022

Now that we’ve covered the highlights, here are the three main factors influencing the farm income forecast in 2022.

1. Cash Receipts

While the USDA expects total cash receipts in 2022 to reach their highest level on record, it’s important to recognize the combative pressure that rising production costs place on higher cash receipts.

2022 commodity cash receipts are projected to reach $525.3B, 21.2 percent higher than in 2021. Total crop receipts are expected to increase by $36.4B or 15.3 percent due to higher receipts for soybeans, corn, and wheat. In addition, cash receipts for animal and animal products are expected to increase by $55.3B or 28.3 percent as a result of increases across every category of animal and animal product cash receipts.

Annual cash receipts for each major U.S. ag export are as follows:

- Cattle and calf: $84.6B (+16 percent)

- Corn: $83.0B (+16.7 percent)

- Soybeans: $63.5B (+30.6 percent)

- Dairy products: $57.0B (+36.4 percent)

- Broilers: $49.3B (+56.7 percent)

- Hogs: $30.5B (+8.9 percent)

- Wheat: $15.7B (+33.7 percent)

- Chicken eggs: $15.3B (+76.3 percent)

- Hay: $10.1B (+19.2 percent)

Note: Percent changes are calculated from 2021 values.

2. Direct Government Payments

Due to lower supplemental and ad hoc disaster assistance for COVID-19 relief, direct government payments are expected to decline by $12.8B or 49.7 percent to $13.0B. This is a sharp decline from 2020 when direct government payments accounted for nearly half of farm income. After falling to nearly a quarter of net farm income in 2021, 2022 direct government payments are expected to comprise less than 10 percent of net farm income. This means that farmers will have to rely more on crop and livestock receipts and fluctuating commodity prices.

Moreover, due to high commodity prices and the outdated reference prices in the current Farm Bill, PLC and ARC program payments are practically nonexistent.

With fewer government payments, it may be wise to consider increasing your operation’s cash flow to address rising input costs and keep your operation on track for success.

3. Production Costs

Input costs are expected to reach $437.3B, a 17.8 percent increase from 2021. Spending across all categories is expected to increase with the largest increase for fertilizer, lime, and soil conditioner.

Other production costs by category include:

- Feed: $75B (+14.9 percent)

- Fertilizer, lime, and soil conditioner: $45B (+52.3 percent)

- Labor: $40B (+9 percent)

- Livestock and poultry: $35.5B (+15.7 percent)

Note: Percent changes are calculated from 2021 values.

Focus on What You Can Control and Improve Your Financial Health

Although net farm income is expected to increase this year, rising production costs continue to take a toll on farms across the nation.

In addition, farmer uncertainty is amplified by an ambiguous legislative future. Federal funding for agriculture programs will largely depend on what’s decided in the 2023 Farm Bill.

And while you can’t control input costs or legislative decisions, you can control how prepared you are. And managing your operational liquidity is an effective way to support your operation’s growth.

Explore AgAmerica’s working capital loans to sustain your operation through rising production costs and uncertainty.