(Infographic) Top Three Reasons for an Ag Loan

AgAmerica Lending Brings Experience and Innovation to Agricultural Lending

AgAmerica Lending is one of the largest non-bank agricultural lenders in the United States, focused solely on agricultural real estate financing. AgAmerica is changing the way today’s farmers, ranchers, and landowners finance their dreams with their spectrum of conventional and alternative land loan programs.

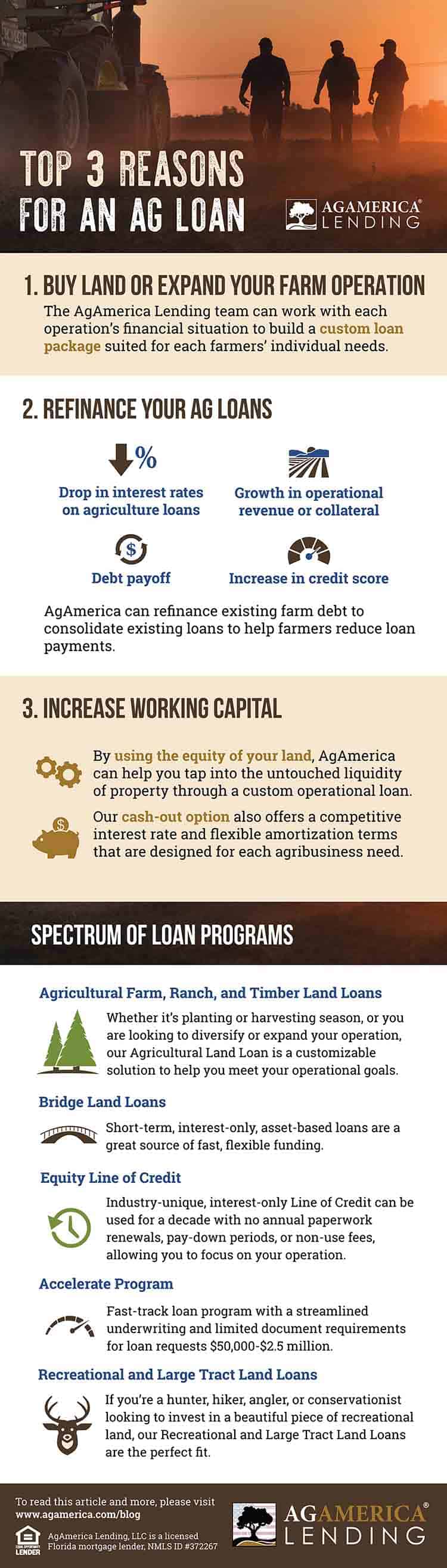

Buy Land or Expand Your Farm Operation

With many factors outside the farmers’ control, the stringent qualifications required by most lenders pose a significant challenge to today’s landowners. If you are a multi-generational farmer looking to purchase new land to expand your operation, the AgAmerica Lending team can work with each financial situation to build a custom loan package suited for each farmers’ individual needs.

Refinance Your Ag Loans

AgAmerica’s team of financial experts take a hands-on approach when it comes to helping farmers manage finances and lending expectations. They take a holistic view of current farm debt, including operational loans, farm machinery, and land real estate to build a custom loan package that will help consolidate existing debts into one term loan. Ultimately, AgAmerica’s mission is to help farmers save money that can be used as a reinvestment into agribusinesses for future endeavors and operational upgrades.

Periodic changes in farmers’ financial situations will often present opportunities to refinance and structure new loan terms to better serve each unique financial portfolio. These situations include:

- An increase in credit score;

- A debt payoff;

- Growth in operational revenue or collateral; or

- A drop in the interest rates on agriculture loans.

Taking all financial factors into consideration, AgAmerica can refinance existing farm debt to consolidate existing loans to help farmers access more working capital.

Increase Working Capital

Working capital provides the financial cushion farmers need to endure the tougher farming seasons and stay on track with long-term business goals. It’s a vital resource that can help fund larger farm projects such as replacing aging equipment, investing in precision technologies, or making repairs after a natural disaster.

Farmers and ranchers understand how an unexpected repair can greatly impact an operation’s bottom line at the end of the year and even years to come. Having access to an available cash flow removes the pressure to hold off or delay necessary purchases such as seed, fertilizer, or livestock feed because of funding challenges.

Tap Into the Liquidity of Your Land

By utilizing the equity of your land, AgAmerica can help landowners tap into the untouched liquidity of property through a custom operational loan that can be used to fund purchases such as farm equipment, irrigation systems, ag tech, storage silos, or seed supply. Their cash-out option also offers a competitive interest rate and flexible amortization terms that are designed for each unique agribusiness need.

AgAmerica’s team of experienced ag lenders build custom loan packages based on the unique needs of operations and farmland to match each farmer or rancher with a loan solution that supports long-term success.

Our Spectrum of Loan Programs

Agricultural Farm, Ranch, and Timber Land Loans: Whether it’s planting or harvesting season or you are looking to diversify or expand your operation, our Agricultural Land Loan is a customizable solution to help you meet your operational goals.

Bridge Land Loans: We understand farming has its ups and downs. Our short-term, interest-only, asset-based loans are a great source of fast, flexible funding.

Recreational and Large Tract Land Loans: If you’re a hunter, hiker, angler, or conservationist looking to invest in a beautiful piece of recreational land, our Recreational and Large Tract Land Loans are the perfect fit.

Accelerate Program: If you are borrowing $50,000 – $2.5 million on a minimum of 50 acres, with a credit score of 680 or higher, you could qualify for AgAmerica’s Accelerate program. They offer qualified applicants less than a 24-hour loan approval with a closing process of fewer than 30 days.

Equity Line of Credit: AgAmerica offers a modern approach to lending through our 10-year line of credit. This industry-unique, interest-only line of credit can be used for a decade with no annual paperwork renewals, pay-down periods, or non-use fees, allowing you to focus on your operation.

Modern Lender with a Traditional Approach

As a non-bank lender, AgAmerica has the flexibility to offer farmers, ranchers, and landowners the opportunity to work with trusted advisors that are experts in land lending, letting them use their finances to operate their farm operation however they see fit. AgAmerica’s tiered pricing creates borrower-specific solutions based on financial goals and loan risk. Taking a common-sense, collateral-focused approach to underwriting, they create options for farmers and landowners that traditional income-based loan programs cannot. When it’s time to make improvements to protect what you have worked so hard to build, or if you are looking to expand your current operation, we are here to partner with you.

Contact AgAmerica to discuss a custom financial solution that will help you accomplish your long-term goals.