Increase Working Agriculture Capital to Support Farm Longevity

Amid an unpredictable and competitive industry, securing working capital and cash flow for your operation is key.

With so many rising obstacles, increasing working capital has never been more important. In recent years, American farmers and ranchers have dealt with numerous challenges outside of their control that have placed a strain on operational liquidity. Rising input costs and inflation have limited cash flow while severe weather events have led to crop damage and lower yields.

In the face of the current uncertainty surrounding the U.S. economy, farmers are proactively engaging with lenders to lower expenses, restructure existing debt, and secure the working capital needed to keep their operation thriving.

High liquidity is what enables farmers to continue meeting financial obligations despite the many uncontrollable obstacles they face. In addition to helping you endure financial challenges, liquidity is needed to finance the initial development of new business models. Keep reading to learn more about the resources available to help you increase your working capital.

“Cash is king right now. Look at your balance sheet, and if you don’t have enough potential working capital, talk to your lender about your line of credit.”

Brian Philpot, AgAmerica CEO

How to Calculate Working Capital

Before discussing the importance of working capital for your operation, it is important to understand how to calculate and evaluate it. Working capital is equal to your assets less your liabilities.

“Working capital is the liquid funds that a business has available to meet short-term financial obligations.”

In addition to meeting short-term goals, having access to working capital also ensures the long-term longevity of your operation.

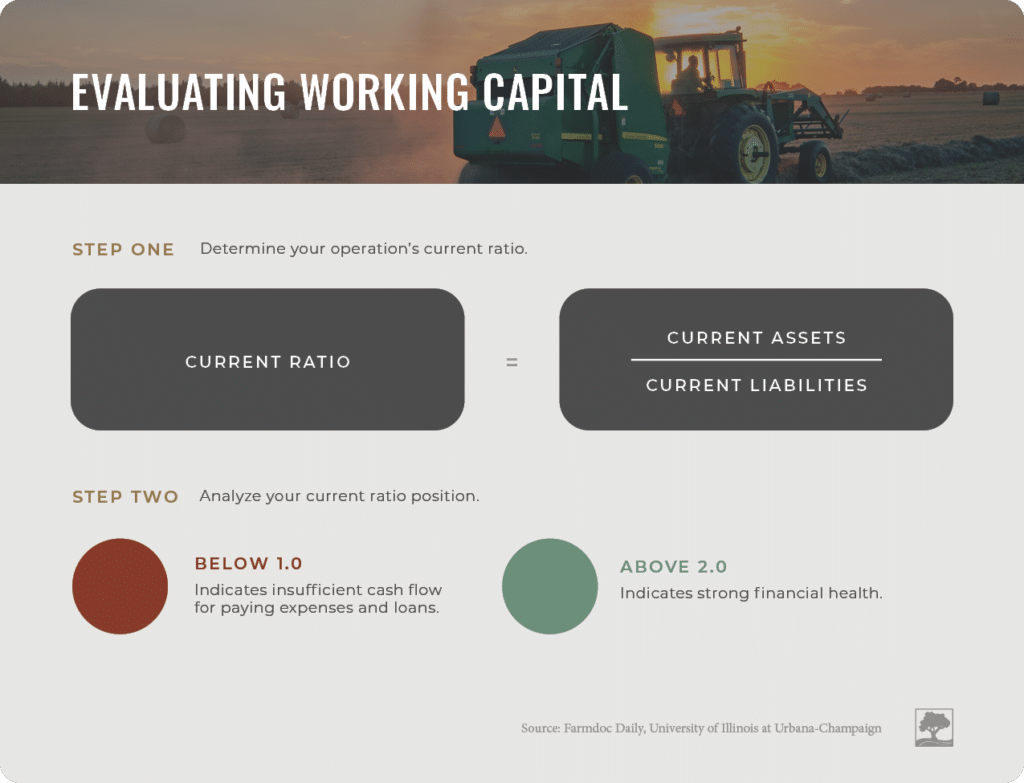

After calculating working capital, one of the first steps when analyzing it is to decide whether you need to increase it. Farmdoc Daily from the University of Illinois at Urbana-Champaign shared helpful guidelines for analyzing your working capital.

*Note: These numbers are estimates and can vary by operation.

Discussing your financial situation with your trusted lender who understands the unique strengths and challenges of the ag sector can:

- Uncover alternative options that can lower payments; and

- Boost necessary working capital to fund your operation through economic uncertainty.

Evaluating your financial health and discussing opportunities for improvement, are the first steps to take towards creating a more financially secure operation.

Equip Your Operation for Growth with Working Capital

The time is now to take action and use the value of your land to increase your working capital.

“Plan for it, right now. Farmers have to have cash on hand and available credit to weather the storm and get crops in the ground on time.”

Brian Philpot, AgAmerica CEO

In addition to acting as a safeguard against uncontrollable challenges, working capital enables you to invest in the future of your farm through operational enhancements that extend your reach and broaden your impact. Keep reading to learn how to increase your working capital with one of AgAmerica’s flexible financing programs.

Working Capital Loans

AgAmerica’s flexible spectrum of working capital loans puts the value of your land to use and increases your liquidity and purchasing power. In addition, our flexible terms range up to 30 years. With various options to choose from, we can structure a custom loan that best suits your unique needs and is capable of adjusting to your goals as they evolve.

Some of AgAmerica’s working capital loan options include:

- Cash-Out Operational Loans: Gain access to cash and increase profit potential.

- 10-Year Line of Credit: Utilize unlimited cash draws for any business purpose.

- Flexible Short-Term Loans: Boost your liquidity with a short-term line of credit.

Restructure Existing Debt and Reduce Payments

Working capital has become increasingly lean over the years, causing many farmers to begin dipping into their equity to fund operational expenses. Consolidating multiple farm loans into a single term loan at a lower interest rate is an alternative way to increase working capital. This type of debt restructuring creates a more flexible financial operation, which in turn allows you to adapt faster during volatile or disruptive seasons.

Working with the right lender to refinance debt opens the door to more opportunities for expansion and operational upgrades.

Texas Ranchers Upgrade Property with $2.3MM Working Capital Loan

After realizing the potential of refinancing their existing debt and increasing their working capital, Texas ranchers worked with AgAmerica for a flexible loan package. After refinancing, they were able to secure $2.3MM in flexible working capital to invest in the expansion of their operation.

At AgAmerica, we are committed to providing farmers and ranchers with flexible financing packages that free up cash flow for their operation. Whether securing additional cash flow or restructuring existing debt, having access to working capital equips you with the freedom to elevate your operation to the next level.

Complete our Accelerate Land Loan application today to begin your journey towards financial independence.